With nearly 950,000 online Self Assessment returns received so far this tax year, HMRC is encouraging others to follow suit and file their tax returns as soon as possible. Thousands of citizens opt to file early next year, as soon as one tax year ends and the next one begins.

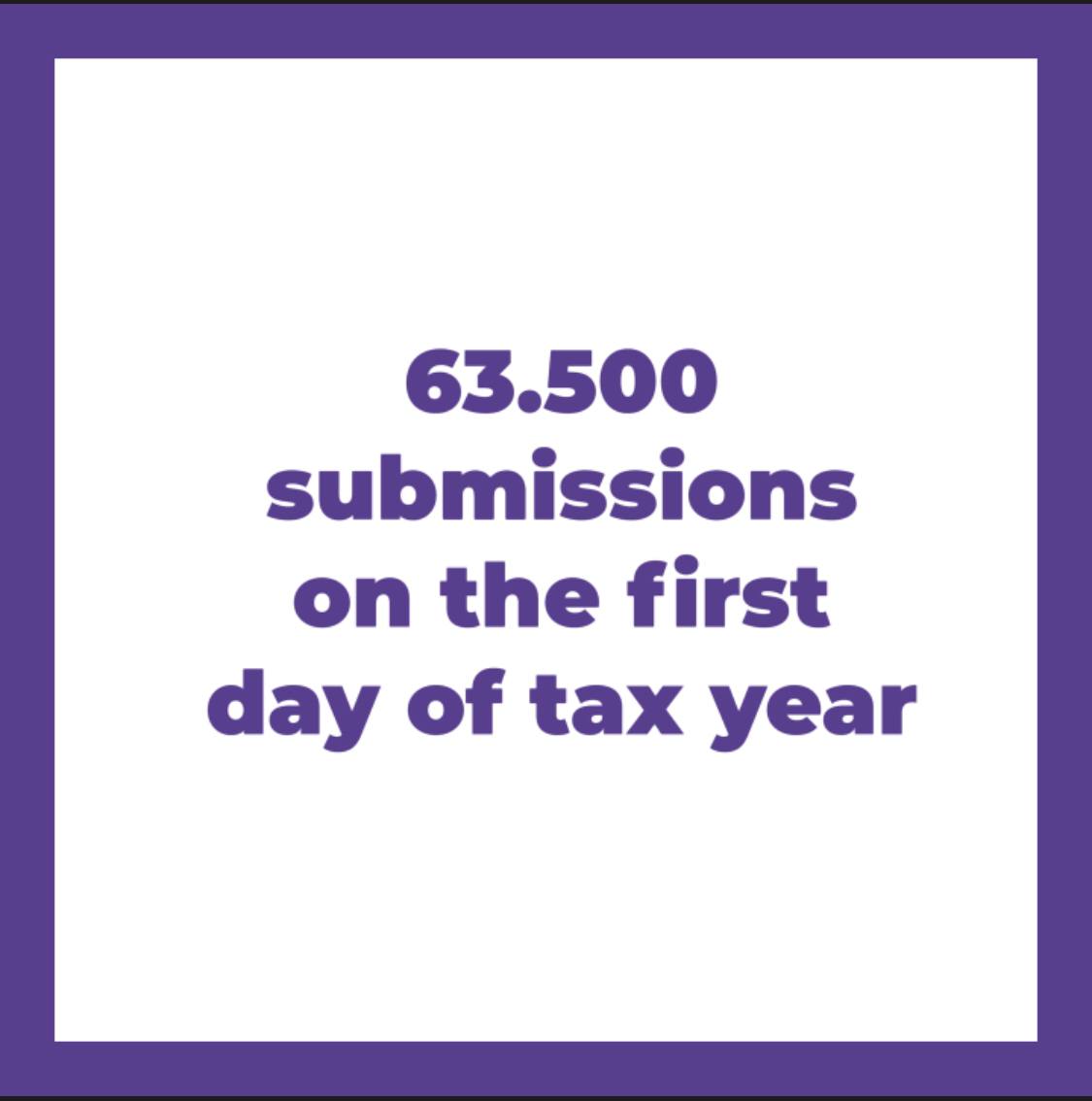

HMRC has seen an increase in early filers. The number of customers opting to file on the first day of the new tax year has nearly tripled in the last five years, from 22,885 in 2017 to 63,521 in 2021.

HMRC released information on Tuesday 18th May 2021 to assist customers in filing early – how to do it, what the benefits are, and what they need to get started.

The HMRC Self Assessment guide will assist consumers in completing their tax returns. Customers do not need to wait to apply their Self Assessment; they can do so whenever it is convenient for them, avoiding any last-minute scramble to reach the deadline on January 31, 2022.

HMRC's Director General for Customer Services, Myrtle Lloyd, said:

“There are many advantages to completing your Self Assessment tax return sooner rather than later, not least that if you’re due tax refund you’ll get the money within a few days.”

“Our new online guide helps answer many of the questions customers have about Self Assessment. Go to GOV.UK and search ‘file your tax return early’.”

It contains useful information on:- When to get assistance with your tax return;

- How to declare furlough fees, Self-employed Income Support Scheme grants, or other COVID-19 assistance initiatives;

- What details you'll need before you can begin filing your tax return;

- Assistance with bill payment;

- What do you do if you have paid too much tax?

HMRC recognises that the pandemic has become a source of concern for Self Assessment customers and is doing everything possible to assist them in correctly filing their tax returns and meeting their obligations. GOV.UK also has guidelines and help sheets in addition to the factsheet.

Customers should also be aware of phishing scams and fake HMRC websites. They can go to GOV.UK and check for ‘self-assessment' to get the correct connection for their Self Assessment tax return online, safely and for free. They should also be wary if anyone calls, emails, or texts them pretending to be from HMRC, demanding bank or other personal information, threatening arrest, or demanding a money transfer. It could be a scam.

Anyone who is uncertain may use the GOV.UK checklist to determine if the contact they got is a scam. Please review our Self Assessment services, and if you need the assistance of a personal accountant to file your Self Assessment, please contact Persona Finance [enquiries@personafinance.co.uk].